цены на солнечные навесы для автомобилей

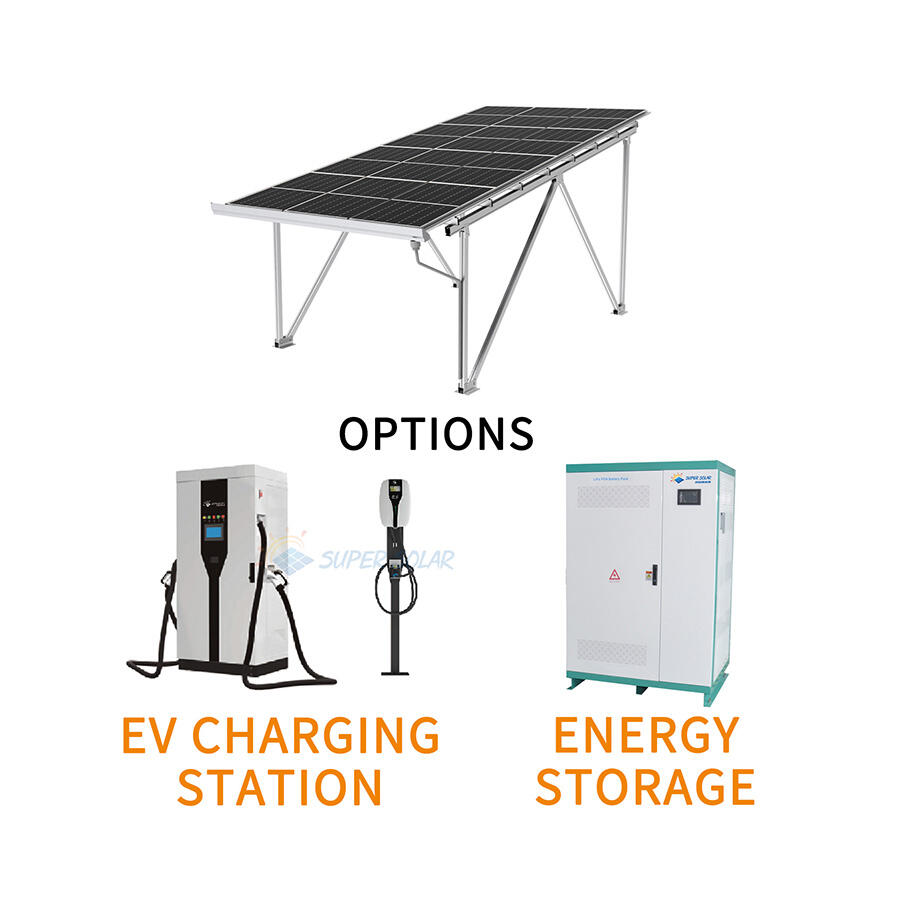

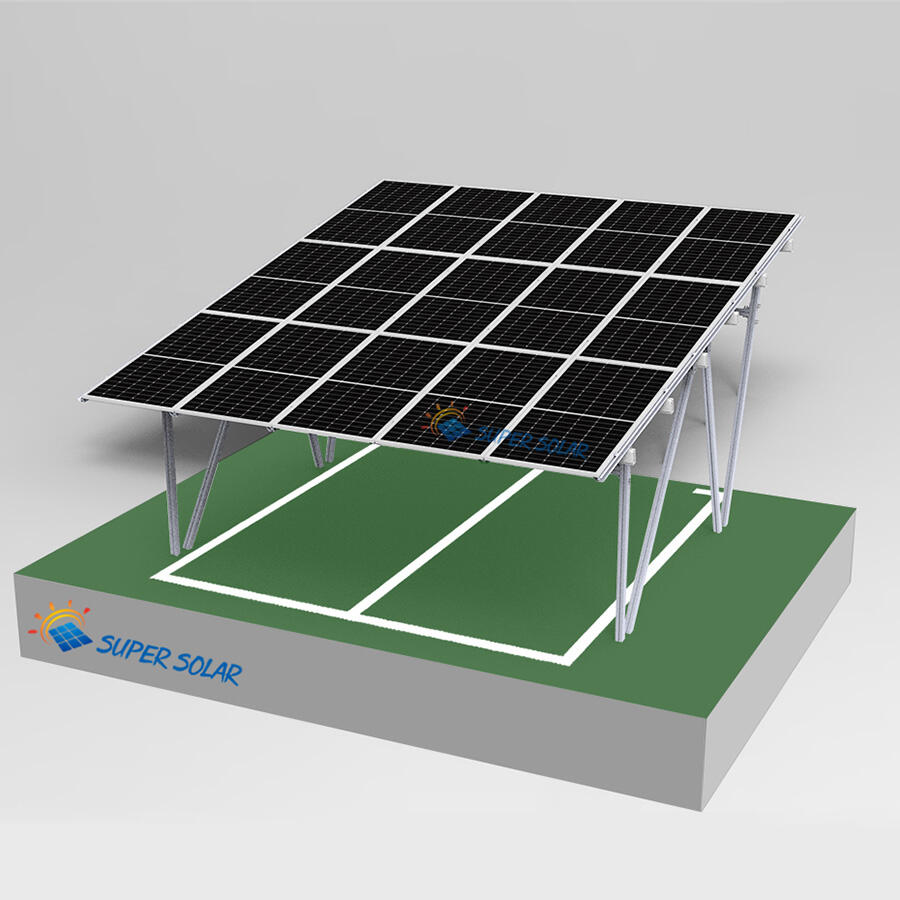

Цены на солнечные навесы представляют собой комплексное инвестиционное решение, сочетающее устойчивую генерацию энергии с практичной инфраструктурой парковок. Эти инновационные конструкции выполняют двойную функцию: обеспечивают крытые парковочные места и одновременно вырабатывают чистое электричество с помощью фотогальванических панелей, установленных на навесе. Структура ценообразования на солнечные навесы включает различные компоненты: подготовку фундамента, стальной каркас, установку солнечных панелей, электрические системы и расходы на техническое обслуживание. Современные солнечные навесы используют передовые монтажные системы, обеспечивающие оптимальное положение панелей для максимального сбора энергии в течение дня. Технологическая платформа включает высокоэффективные солнечные панели, надежные инверторные системы и функции интеллектуального мониторинга, отслеживающие выработку энергии в режиме реального времени. Стоимость установки значительно варьируется в зависимости от условий площадки, местных нормативов и технических характеристик системы. Обычно цена на солнечные навесы составляет от пятнадцати до двадцати пяти долларов за квадратный фут покрытой площади, что делает их конкурентоспособными по сравнению с традиционными парковочными сооружениями, при добавлении ценности генерации энергии. Модульная конструкция позволяет масштабировать установки в соответствии с различными потребностями парковки и бюджетными ограничениями. Применение современных материалов, устойчивых к погодным условиям, обеспечивает долговечность и минимальные затраты на обслуживание. В структуре ценообразования предусмотрены комплексные гарантии, охватывающие как прочность конструкции, так и гарантии выработки энергии. Современные установки оснащены встроенными светодиодными системами освещения, работающими непосредственно от солнечных батарей, что снижает эксплуатационные расходы. Наличие функций интеллектуальной зарядки обеспечивает интеграцию электромобилей, ставя эти сооружения в авангарде тенденций электрификации транспорта. Расчёты рентабельности показывают привлекательные сроки окупаемости, как правило, от семи до двенадцати лет, в зависимости от местных тарифов на электроэнергию и доступных льгот. Профессиональные монтажные бригады обеспечивают соответствие местным строительным нормам и электротехническим стандартам. Ценообразование на солнечные навесы отражает сложность инженерных решений, необходимых для балансировки нагрузок на конструкцию и повышения эффективности генерации энергии в различных географических и климатических условиях.