Superior Energy Generation and Cost Savings

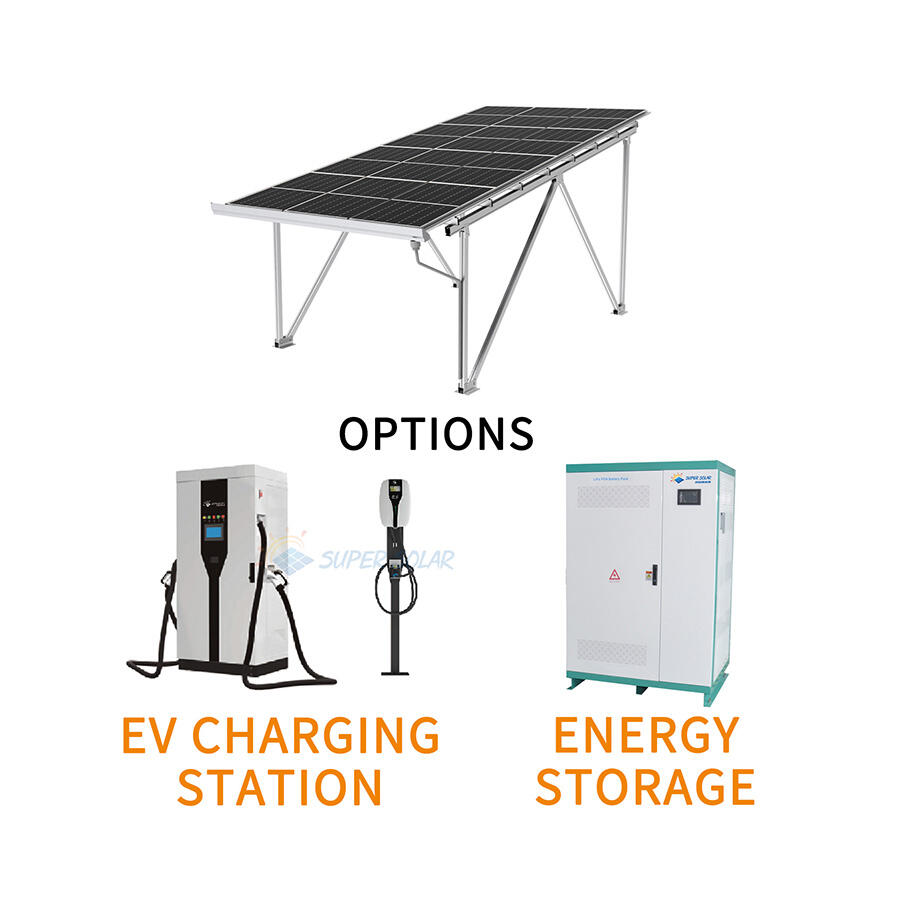

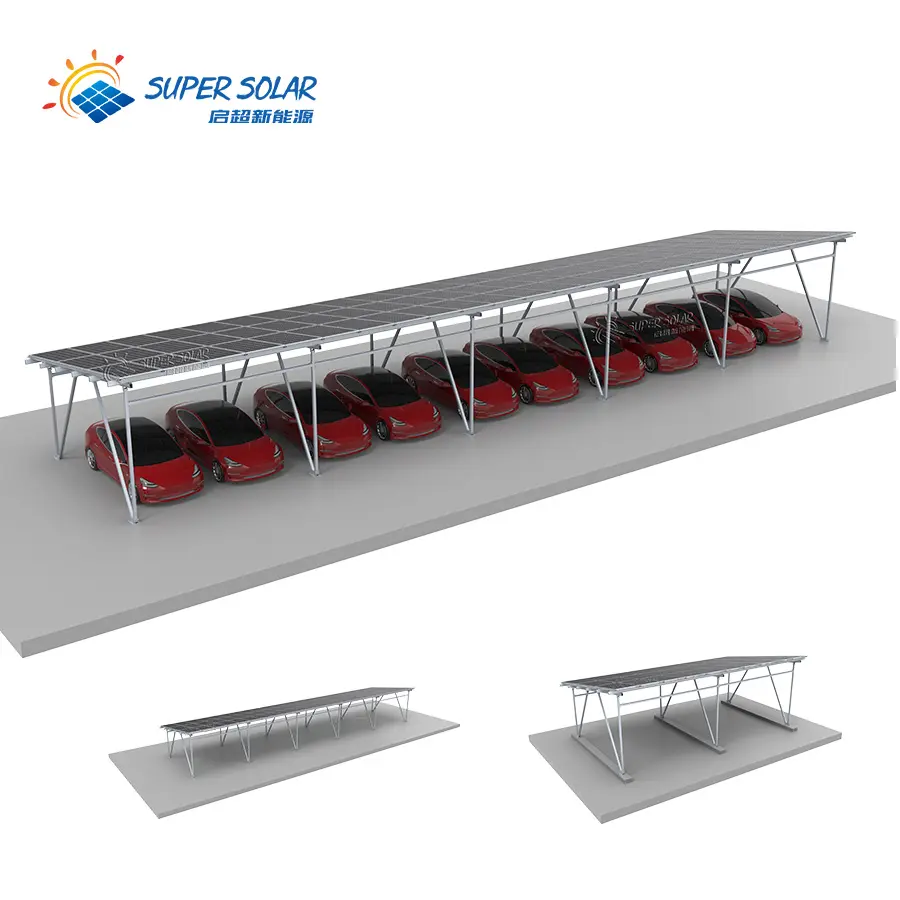

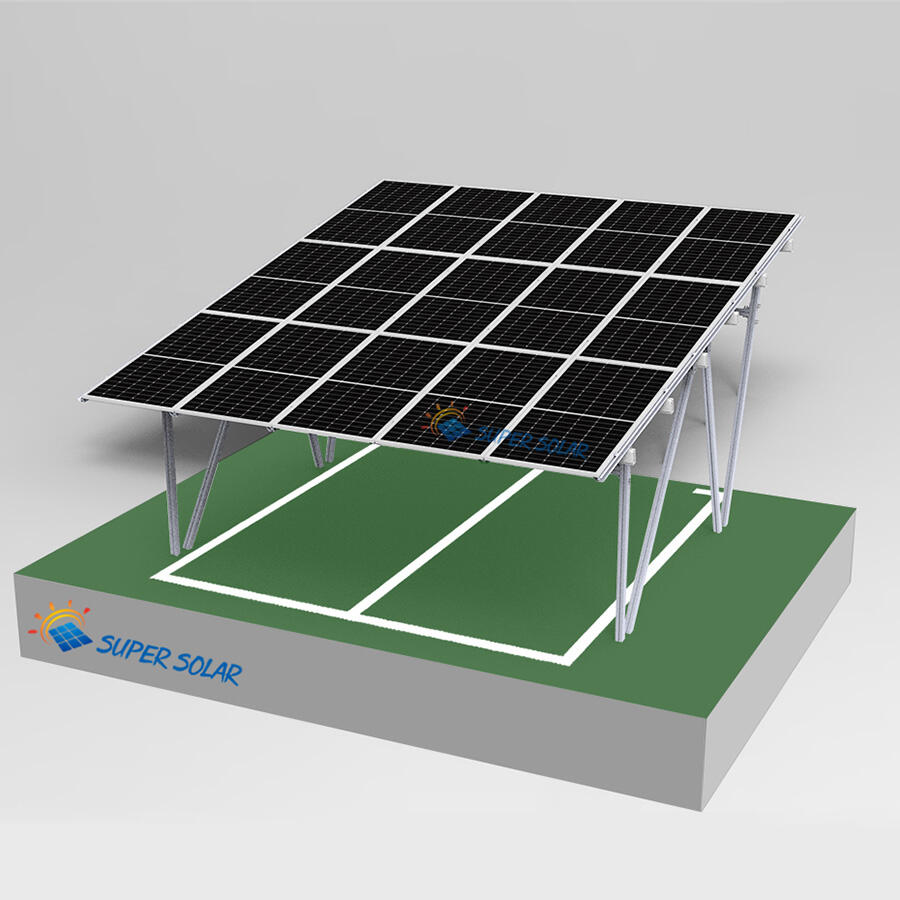

Solar carports deliver exceptional energy production capabilities that often exceed traditional rooftop installations due to optimal positioning, superior ventilation, and elimination of architectural constraints that limit panel orientation and tilt angles. The elevated mounting position allows engineers to configure arrays for maximum solar exposure throughout the year, incorporating seasonal sun angle variations and local weather patterns to optimize electricity generation. Advanced photovoltaic modules featuring high-efficiency crystalline silicon cells or innovative thin-film technologies capture more sunlight per square foot than earlier generation panels, while improved inverter systems convert direct current to alternating current with minimal power losses. The open-air installation environment provides natural cooling that enhances panel performance, as excessive heat reduces photovoltaic efficiency significantly compared to well-ventilated systems. Real-time monitoring systems track energy production, system performance, and potential maintenance needs through sophisticated software platforms accessible via smartphones, tablets, or computers, enabling proactive management and rapid issue resolution. Grid-tie configurations allow excess electricity generation to flow back into utility networks through net metering programs, creating credits that offset consumption during periods of low solar production such as evenings and cloudy days. Battery storage integration options provide energy independence and backup power capabilities, storing excess daytime generation for use during peak rate periods or power outages, further maximizing economic benefits. The financial returns from solar carports typically exceed those of traditional investments, with payback periods ranging from six to twelve years depending on local utility rates, available incentives, and system size. Federal investment tax credits currently allow property owners to deduct thirty percent of installation costs from federal taxes, while many states and utilities offer additional rebates, performance incentives, or renewable energy certificates that improve project economics. Commercial properties benefit from accelerated depreciation schedules that provide substantial tax advantages during the first few years of operation, while increased property values reflect the long-term asset value of renewable energy infrastructure. Electricity cost hedging protects against future utility rate increases, which historically average three to five percent annually, providing predictable energy costs for business planning and household budgeting purposes.